In the era of dynamic economic changes and the increase in the number of restructuring proceedings, the importance of effective risk management tools is growing. This article analyzes the role of early warning systems in companies and the justification for engaging restructuring advisers already at the stage of crisis prevention. By comparing economic theory with the practice of financial audits, we point to the key determinants of insolvency and recommend specific corrective actions.

Contents:

A few words about the article - Listen

The determinants of the crisis in economic theory are still relevant in the context of the growing number restructuring proceedings. The justification for including the competences of a restructuring advisor in early warning systems in companies therefore seems reasonable from the point of view of stakeholders.

Crisis as an economic phenomenon

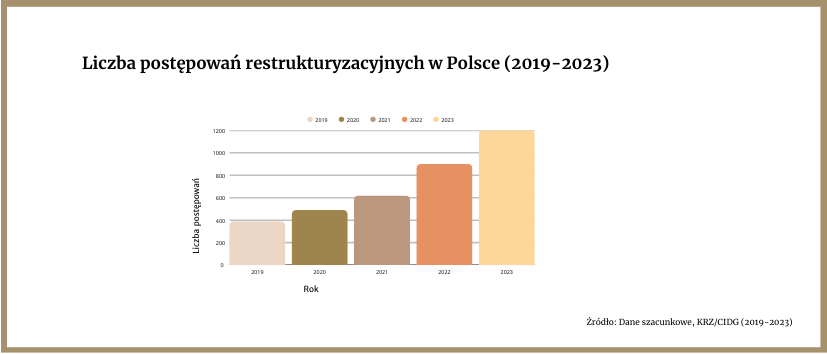

The crisis itself is a natural, necessary state that results from the cyclical nature of the economy and is reflected in economic theory, however, recent years have shown how unpredictable the environment in which entrepreneurs currently operate and how many unforeseen challenges they have to face. All this means that in the face of liquidity disruptions, they are looking for solutions that will allow them to maintain their business and provide the time necessary to implement adjustment measures, which is why they are gaining popularity. restructuring proceedings. The total number of restructurings in the last two calendar years increased by as much as 102.6%, which implies questions about the moment at which entrepreneurs identify threats, determinants of the crisis on a micro scale and early response systems in companies. The unreliability of early warning systems and, consequently, the lack of reliable information in real time, and not formulated ex post, has become a matter of debate.

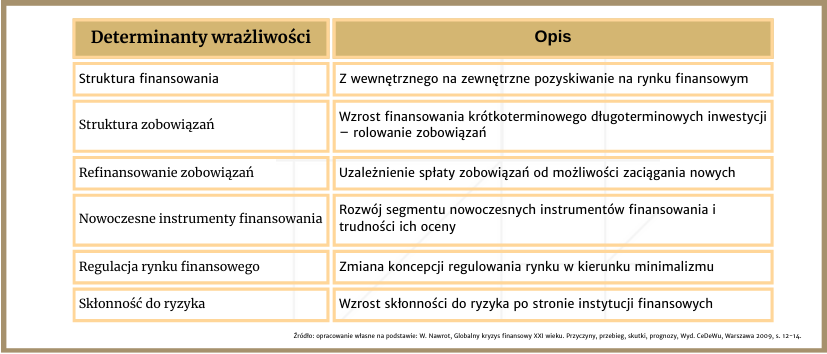

The division of crisis determinants was first described by Minsky. In his work Stabilizing an Unstable Economy, he distinguished factors that are characterized by the greatest sensitivity.

Table 1. Reasons for the vulnerability of the modern financial system

Determinants of the crisis according to Minsky

In his model, he noted that a crisis can be caused not only by fluctuations in highly sensitive elements, but also by information stability that promotes increased optimism, higher development forecasts, and an increased number of risky investments. Information optimism is manifested among various interest groups. The first group consists of investors who, based on the image of reality created in financial reporting, start to take increasingly higher investment risk. Their tendency to take on debt is also growing. The second group are banks, which, on a wave of optimism, are expanding their lending to new risk groups that were previously excluded. There are three stages here:

hedge financing - otherwise secured financing, i.e. prudent granting loans preceded by a thorough analysis of creditworthiness,

speculative financing – otherwise known as speculative financing, i.e. loans granted to people who are able to repay the interest, and the repayment of capital installments depends on economic growth and income growth,

ponzi financing – otherwise known as unsecured financing (the name ponzi comes from the creator of the first financial pyramid), i.e. loans granted to people who, at the time of application, are not able to repay them.

The third group are market participants subjected to the follow the leader phenomenon. Their actions lead to the creation of a speculative bubble, which is a derivative of many irrational and unprofitable investments.

The presented reasons for the sensitivity of the crisis, although developed in the 1980s, do not lose their relevance and the vast majority of them can be indicated as the sources of the decision to choose the restructuring path. In the course of analyses undertaken by restructuring advisors - whether as managers, supervisors or receivers - unfortunately, the conclusion is very often drawn that financial liabilities result primarily from banking products granted on the basis of an insufficient or too optimistic assessment of creditworthiness, and the corrective actions taken by the entity are late. The rising costs of external financing, rolling over liabilities, the development of funds financing high-risk projects, or an overly optimistic approach to the assessment creditworthiness by both financial institutions and contractors (trade credit) and the lack of systems for early identification and response to the above-mentioned factors are still the main determinants of the upward trend in restructuring proceedings.

When looking for reasons/sources of delays in management information, the first line of business is data created by the accounting system. We observe a certain shift in the center of gravity from the information and control function, which had unquestionable values of universality and objectivity. The variety of purposes of information created by the accounting system, as well as the existence of a wide group of recipients, means that there is a certain space for freedom of presentation, which we also deal with in restructuring or bankruptcy audits.

It is necessary to strive to spread the idea of corporate social responsibility in terms of disclosed information and stricter control in terms of early warning signals, postulating the inclusion of restructuring advisors in the control processes of companies - not only within the framework of restructuring or bankruptcy proceedings. It should be noted that restructuring audits are currently gaining importance, which are carried out by restructuring advisors in the event of determining the existence of premises for the threat of insolvency or the occurrence of the insolvency phenomenon, together with a recommendation of actions within the framework of the early warning system. Audits protect management against liability for failure to meet statutory deadlines and contribute to the protection of creditors' interests.

Failure of early warning systems

The demand for the involvement of advisors in early warning systems is justified, above all, by:

– impartiality and objective approach to the analysis of financial data;

– ability to evaluate economic decisions;

– broad competences in the projection and implementation of recovery programmes;

– interdisciplinarity of the profession;

– knowledge of regulations and deadlines in the area of assessing the risk premise and occurrence of the phenomenon of insolvency.

Restructuring advisors have broad competences and experience in the assessment and analysis of data generated by accounting and financial reporting systems; projection of restructuring plans, opinions on the possibility of implementing arrangements, and assessment of the admissibility of granting public aid. Their competences are commonly used within early warning systems (broadly understood controlling) can help reduce the risk of crisis factors and accelerate decisions, protecting enterprises and the interests of the entire business environment.

The importance of accounting in diagnosing threats

Summary

The inclusion of restructuring advisors in the control processes of companies provides significant support in the fight against the coming crises. Their competences – from the analysis of financial data to the design of corrective actions – can effectively support early warning systems, minimizing the risk of insolvency and protecting the interests of both companies and their creditors. It is therefore worth treating restructuring audits not as a last resort, but as a permanent element of the risk management strategy.