The year 2023 brought with it extraordinary challenges for economies around the world. The COVID-19 pandemic had a huge impact on many sectors and industries, leading to a record number of consumer insolvencies.

In this article, we will present PMR Restructuring law firm's forecasts for the near future and look at the causes of this phenomenon and the implications of a record number of consumer insolvencies in 2023.

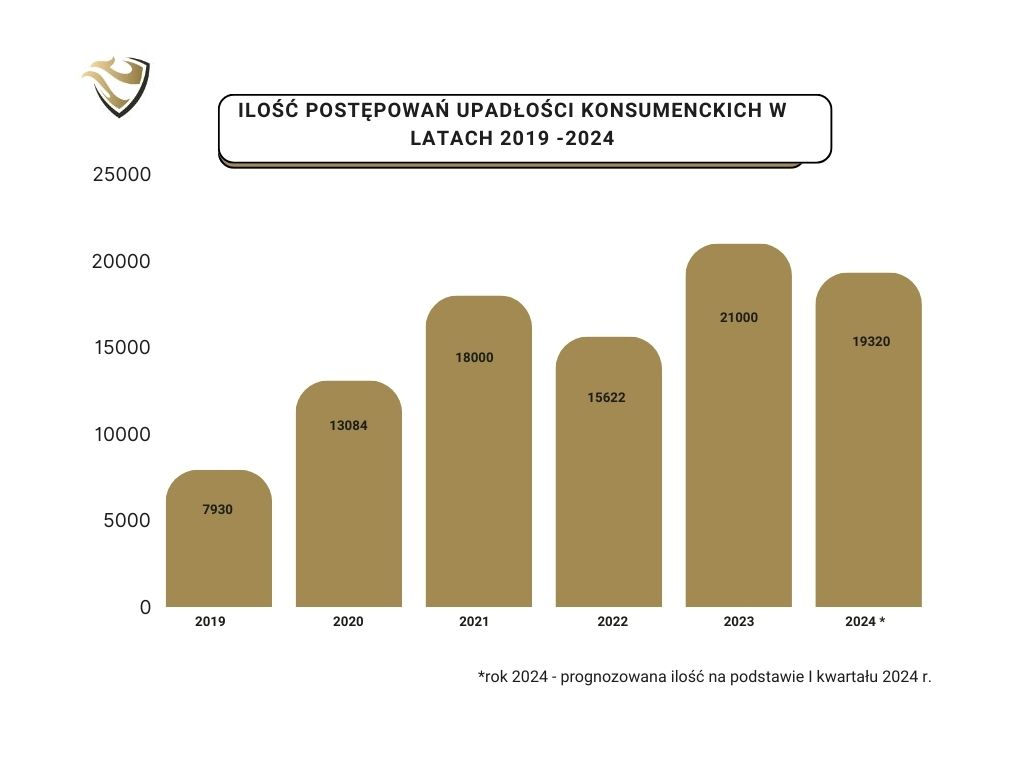

Consumer bankruptcies in figures

In 2020, the number of consumer insolvencies was relatively low at the beginning of the year, but noticeably the COVID-19 pandemic has affected the economy and caused huge changes. Restrictions and lockdowns have led to the closure of many companies, layoffs and loss of income for many people. As a result, the number of consumer insolvencies in Poland started to increase to eventually reach an unprecedented 13,084 consumer insolvencies and a record growth rate for 2019 i.e., 65%.

The number of consumer insolvencies remains high in 2021, However, we are seeing a decline in the growth rate from a record 65% to 39%. Nevertheless, in absolute numbers we are seeing an increase in the number of bankruptcies consumer proceedings year-on-year by 5121 proceedings, which already total more than 18,000 this year.

In 2022, the number of consumer insolvencies remains at a high levelbut we are seeing a reversal of the trend and a year-on-year decrease in the number of newly opened consumer proceedings to 15622 proceedings.

In 2023, we again see a surge in new consumer proceedings, which reaches an unprecedented 21,000 proceedings.

In Q1 2024, 5402 new consumer proceedings were opened, according to data collected by the Central Economic Information Centre. This is still a huge number of new proceedings, nevertheless a downward trend can be observed. Comparing the first quarter of 2023 with the first quarter of this year, we see a reduction in the number of new proceedings opened by almost 8%

Reasons for the record number of consumer bankruptcies:

- Legal liberalisation and increased consumer awareness – on 24 March 2020, an extensive amendment to the bankruptcy law came into force, which greatly liberalised the conditions that must be met for the court to declare consumer bankruptcyThis change, combined with the growing awareness of the introduction of regulations into legal circulation facilitating the debt relief of over-indebted consumers, has led to a sharp increase in the number of individual bankruptcies, including consumer bankruptcies.

- The impact of the pandemic: The COVID-19 pandemic and related lockdowns and restrictions have resulted in job cuts, company closures and the collapse and weakening of many sectors of the economy. A huge number of people lost their source of income, which led to difficulties in repaying financial obligations such as mortgages, credit cards and loans.

- Inflation - growth Cost of Living: Price Increase goods and services, including food, housing, fuel and healthcare, had a negative impact on household budgets. Many people found themselves unable to cover all their current costs and at the same time meet their debts.

- Increase in lending rates - The jump in bank lending and borrowing rates indicates that in 2023, the instalment increase for loans granted in 2018-2020 was around 50-55 per cent, while for 2015-2017 it was around 40-44 per cent.

- No savings – A large proportion of the population did not and still does not have sufficient savings to help in difficult financial situations. The lack of emergency funds leaves us unprepared for unforeseen expenses or loss of income.

- Outbreak of war in Ukraine - After a period of numerous restrictions related to the COVID-19 pandemic, rising inflation and increased costs of doing business, the market slowly started to recover. The trend stalled after Russia's aggression against Ukraine.

Negative and Positive effects of the record number of consumer bankruptcies:

- Unemployment and poverty: The deepening poverty and the growth of unemployment have so far led to negative social changes, poverty and the deepening of poverty. Falling into the vicious circle of excessive debt has led to the exclusion of individuals from social life and pushing them into grey zone. People who lost their source of income and were unable to repay their debts found themselves in a difficult financial situation, which negatively affected their daily lives and those of their families.

- Debt relief - introduction of regulations on consumer bankruptcy in 2015 and then their gradual liberalization led to an increase in the availability of debt relief solutions. Simplification of bankruptcy applications and changes in the conditions for opening proceedings bankruptcy proceedings in relation to consumers and individuals running a business activity enable a way out of poverty and destitution and a dignified return to everyday life.

- Increased burden on the judicial system – the increase in the number of consumer bankruptcies is associated with a greater burden on the judicial system. Courts have to consider a greater number of cases bankruptcy applications, which may lead to delays in resolving cases and extending the duration of proceedings, and thus achieving positive effects related to debt relief and debt cancellation.

- Consequences for the financial sector. – record number of consumer bankruptcies may have a negative impact on the banking financial sector, which directly translates into the availability of relatively cheap credit for the average citizen. A significant number consumer bankruptcy leads to the introduction of changes in the terms of granting bank credits and loans and to tightening the criteria for granting them. As a result, it pushes some interested parties towards parabank institutions.

PMR Restructuring experts' forecast

In our opinion, the economic situation in Poland is step by step starting to improve in the direction expected by the majority of the population. Experienced experts estimate that the improvement in the economic situation will facilitate the flow of receivables and fewer and fewer companies will be in arrears with invoices issued as part of a specific service and the previously lengthening repayment period will improve. Confirmation of the above may be the incoming data on the quality of loan repayments.

The indices published by the Credit Information Bureau show, that across all product types (instalment loans, cash loans, home loans, cards) there has been an improvement, both on a monthly and annual basis. The above should also translate into the number of applications for new consumer insolvency proceedings being filed.