The involvement of public funds in "undisturbed" market activities always carries the risk of selective support and distortion of competition by favouring certain undertakings. The basic definition of state aid can be found in Article 107(1) of the Treaty on the Functioning of the European Union, according to which it is "Any aid granted by a Member State or through State resources in any form whatsoever which distorts or threatens to distort competition by favouring certain undertakings or the production of certain goods shall, in so far as it affects trade between Member States, be incompatible with the internal market"

Contents:

Introductory remarks

In the context of restructuring proceedings, due to the specificity of the debtor's situation, it is necessary to conduct a reliable analysis regarding the qualification of the support provided, because while incorrect qualification of support as public aid results in the inability to obtain additional aid in the future, recognizing support as not constituting public aid is associated with the obligation to repay it. The implementation of such a scenario may negatively affect the debtor's financial liquidity and its ability to implement the arrangement.

Tools for assessing the qualification of support as public aid

With regard to the assessment of the existence of support provided to the entrepreneur by the state or using public resources, the Restructuring Law Act provides for two basic analytical tools.h, the Restructuring Law Act provides for two basic analytical tools.

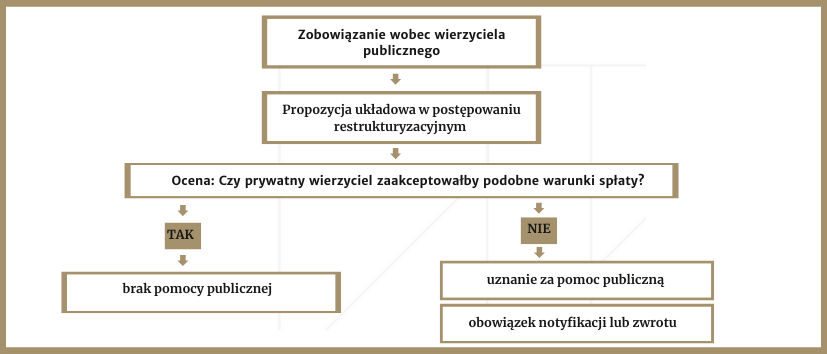

The first and most frequently used is the private creditor test. This tool is used in the context of public debt that has already been incurred. As part of the analysis, an assessment is made of the actions of the public creditor that are planned in the restructuring proceedings, as well as during the implementation of the arrangement. The purpose of this assessment is to determine whether the public creditor takes actions in a given situation in a manner analogous to a private creditor operating in standard market conditions. In other words, the key issue is to determine whether the private creditor would accept the proposed debt repayment terms. This topic was discussed in detail in an article published in January this year

The second test – which is the subject of this study – is the private investor test, which refers to to receivables, which are to be created in the future. According to Article 140 paragraph 4 it states "assessment of the actions taken by the financing entity, carried out in order to determine whether the support does not constitute state aid. Support does not constitute state aid if it is provided on terms that are also acceptable to a private investor". In other words, it comes down to verifying whether a private investor, in a similar situation to a public entity, would make identical investment decisions and whether any financial assistance is not provided on more favourable terms than those generally applicable on the market. Such a test aims to ensure that public support does not distort competition on the market and that it does not lead to an unjustified advantage of one entity over others, which could violate the principles of equal competition.

Practical examples

Example 1

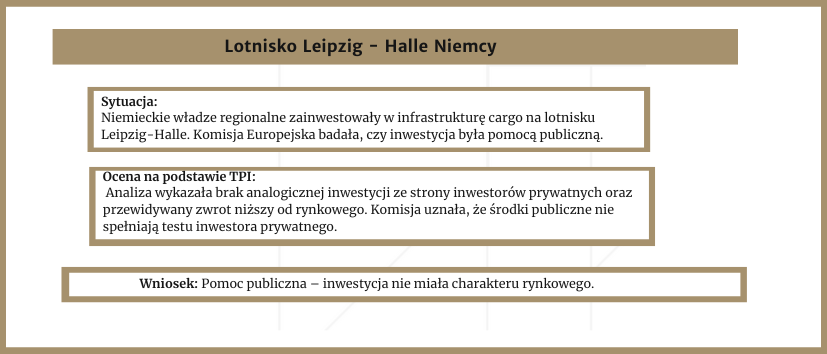

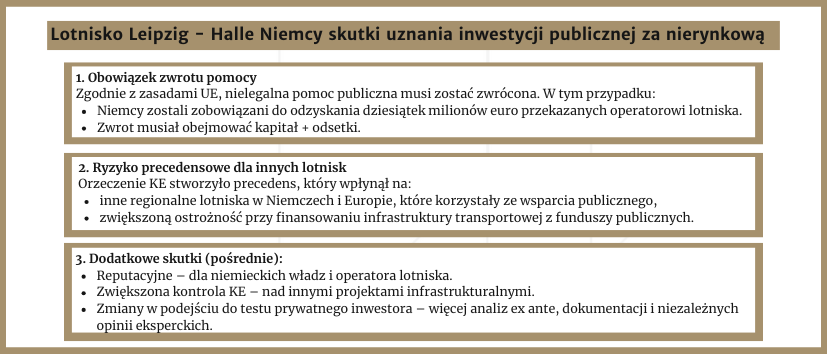

According to the literature on the subject, the foundations of the private investor test derive from the case law of the Courts of the European Union, which, in the course of considering cases concerning the admissibility of state aid, developed the principles and conditions necessary for its verification. Next, the key in this respect was Article 107 of the Treaty on the Functioning of the European Union, which contains the basic definition of state aid. In addition, important guidelines on conducting the private investor test can be found in the European Commission document entitled "Draft Commission Notice on the notion of State aid pursuant to this Article 107(1) TFEU", which specifies the basic prerequisites for the proper conduct of this test

Example 1 – effects

The private investor test in regulations

In the Restructuring Law, only two sections of Article 140 refer to the private creditor test, i.e. section 4, which contains the aforementioned definition of the test, and section 5, which specifies the minimum information scope of the document, according to which: "The private investor test includes in particular information on:

1) the expected level of return on capital employed;

2) the average level of return on capital employed for comparable investments;

3) the expected level of risk accompanying the investment;

4) the average level of risk of comparable investments."

The first two elements, i.e. identification of the expected level of return on capital employed and comparison with the average level of return on capital employed of comparable investments, come down to a situation in which the state expects a normal return on investment obtained by comparable private enterprises. In order to conduct a comparative analysis, it is necessary to apply objective criteria, such as industry, level and time of financing, which are crucial for obtaining reliable results. Given the fact that the content of the act does not contain clear guidelines regarding the adopted research methodology, its choice was left to the analyst.

Research methods

The process of selecting statistical measures and methods in the analysis is a key element of the research process, which should be adapted to the specifics of a given situation. There are many factors influencing the selection of appropriate analytical tools, including the type of financing, the specificity of the industry, the geographical area and the duration of the investment. In this context, the guidelines included in the research recommendations of the European Commission (Commission, 2014) may be helpful, which classify research methods depending on the availability of information and the type of support provided. Their use will ensure compliance of the analysis conducted with the best practices and standards applicable in the area of public investment assessment.

As an access criterion, [1] recommends:

a) when information is available:

- transaction compilation pari passu, which occur when a public and private entity in a similar situation and time independently make the same transaction (the method requires an extremely precise assessment of the conditions of both transactions);

– examination of an open public tender;

b) with limited information availability

– comparative analysis, which is based on the evaluation of comparable transactions;

– calculation methods (IRR – internal rate of return, NPV – net present value, ROCE – return on capital employed)

Within the criterion of the type of intervention

– capital injection – expected rate of return, e.g. from dividends or capital appreciation

– guarantee – the difference between the rate the borrower would pay on the free market and the rate he would obtain thanks to the guarantee, reduced by its costs;

– loan – comparison of normal credit conditions offered by banks;

Referring to the next two elements, i.e. determining the expected level of investment risk and comparing the average level of risk of comparable investments, it is postulated that the measurement should include both individual risk specific to the entity and general (macroeconomic) risk.[2]. Here too, the legislator does not limit the analyst in choosing methods, hence in the studies we can find tests based only on descriptive, computational and mixed analyses.

At this point, the basic classification of market risk measures into measures is considered:

– volatility, where risk is identified as a discrepancy with the expected state, e.g. rate of return distributions, rate of return variance

– sensitivities that reflect the influence of certain variables on expected values, e.g. correlation coefficients,

– threats that are based on the assumption that only unfavourable values should be taken into account for risk measurement, e.g. Value at Risk is a loss of market value for which the probability of reaching or exceeding it in a given time period is equal to a given tolerance level.

The above examples present only selected tools; depending on the complexity of the situation, more advanced tools based on multi-factor models are also available.

As indicated in this study, in the area of preparing the private investor test, the legislator has provided the possibility of a flexible approach to creating the document. The freedom in selecting information tools and the open nature of indicating that the document should contain "in particular" specific information allows for adjusting its information capacity, enabling the scope to be expanded depending on the needs and specifics of the situation.

Although the main purpose of the private investor test is to assess issues related to public aid, this document also plays an important role in the process of obtaining financing. It contains key information that is a valuable source of knowledge for potential investors. The data and analyses presented in it may significantly affect the decision-making process regarding the granting of financing. Proper understanding and interpretation of the content of this document is therefore the foundation for effective cooperation between the investor and the entity applying for financial support. It should be emphasized that the role of TPI is not limited to restructuring proceedings. This analysis is used in the context of each public investment, enabling a comprehensive assessment of its effectiveness and securing against potential negative consequences related to violations of public aid regulations.

[1] M. Cieślukowski "The importance of the private investor test in assessing the efficiency of public investments", Ekonomiczne Problemy Usług no. 4/2017, pp. 65-76.

[2] M. Karpiński, M. Pawelczyk [in:] Restructuring Law. Commentary, ed. A. Torbus, AJ Witosz, A. Witosz, Warsaw 2016, article 140.

Examples of possible applications of the private investor test in practice

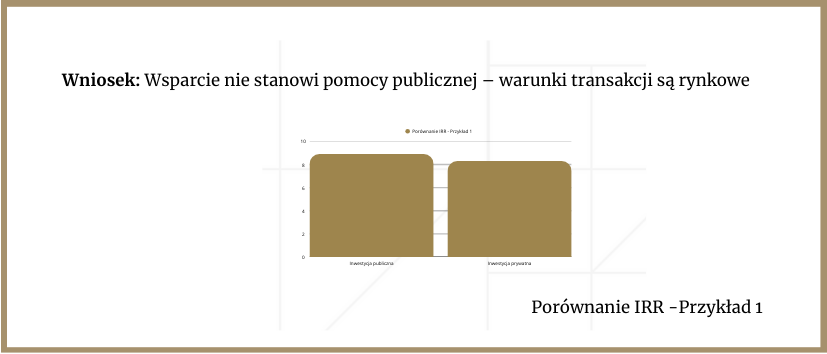

Example 1:

ARP loan for a manufacturing company

A furniture company operating in a region with high unemployment obtains a loan from the Industrial Development Agency (ARP) as part of its restructuring support. The company plans to repay its arrangement liabilities and maintain employment.

The comparative analysis shows that a private investment fund would be willing to lend on similar terms due to the positive cash flow forecast and property collateral. IRR and NPV indicators are close to market.

Conclusion: The support does not constitute state aid – the transaction conditions are market-based.

Example 2:

Investment of local government units in a local business incubator

The local government is investing in the construction of a business incubator, co-financing the operating costs of a technology start-up in exchange for shares.

The analysis showed that industry investors (venture capital) showed interest in similar projects on the same terms. The risk and expected rate of return analysis is within the market range for this type of investment.

Conclusion: The investment meets the private investor test – it is not state aid.

Summary and invitation to cooperation

The private investor test is not only a legal obligation, but also a tool that can become a real support in the process of restructuring and assessing the effectiveness of public investments. A properly prepared document increases the chance of obtaining financing and minimizes the risk associated with public aid.

At PMR Restrukturyzacje, we specialize in developing private investor and creditor tests, as well as comprehensive restructuring advice. Thanks to our experience, we provide reliable analysis, transparent documentation and support at every stage of the proceedings.

Contact us, to find out how we can help your company successfully go through the restructuring process. Trust the specialists – choose proven solutions from PMR Restrukturyzacje.